Get organized and eat healthier are among the top New Year’s Resolutions that people make. If you’re reading this, then you probably want to learn how to make a budget and get your finances under control. You’ve come to the right place! Having a budget and knowing where your money goes is so important. It reduces stress and doesn’t leave you wondering if you’re going to make rent this month (yikes!). Whether you’re a beginner budgeter or just looking to tweak your own strategy, these tips will help you get organized!

First, making a budget is not hard to do. It involves taking a hard look at your income and expenses and making some adjustments if necessary so that you’re living within your means. Sticking to your budget is the hard part. In this post I’ll:

- Teach you how to review your income and spending

- Introduce you to an app that does all the hard work for you

- Talk about the importance of financial goals

- Share my own tips and tricks for how to make a budget

Making a budget doesn’t have to be hard. It doesn’t have to take hours on the first Sunday of the month. I’ve created a worksheet that is simple and meant to make your life easier. Sign me up for that!

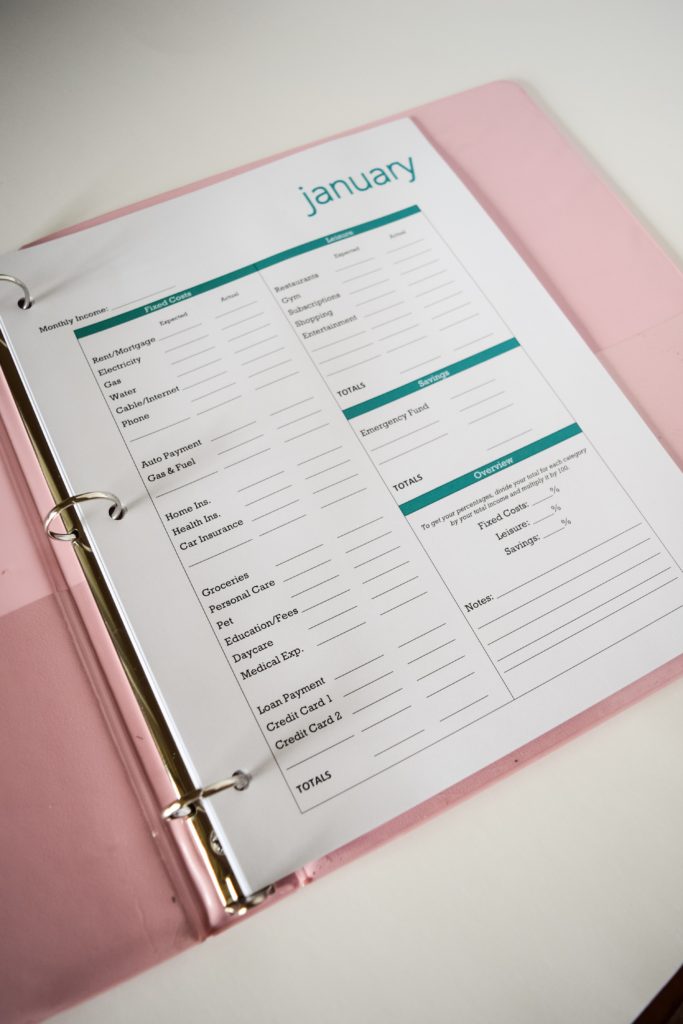

If you’re new to budgeting, I highly recommend that you download this 12-Month Budgeting Worksheet Bundle that will really help you see everything in front of you. I created this worksheet to work for singles, couples, or moms, so if there’s a category that doesn’t apply to you, simply cross it out or leave it blank! This post will walk you through the entire worksheet, so grab this month’s sheet, a cup of coffee, and join me!

50/30/20 Rule

When it comes to creating a budget, we use the 50/30/20 Rule. This means:

- 50% of your income should go to fixed costs, which are things like rent, bills, car payments, and other things that don’t change much from month to month.

- 30% of your income should go to entertainment, like going out to eat, gym memberships, shopping etc. These are things that are just for fun and can theoretically be reduced or eliminated if needed.

- 20% of your income should go into your savings account or IRA. A good friend told me to “always pay yourself first,” so you eliminate the option of even spending that money that should be put away.

These percentages are flexible- find what works best for you! If you live somewhere with a high cost of living, your fixed costs may be a higher percentage. Simple adjust the other categories accordingly.

Now that you have a plan, let’s look at your accounts.

Reviewing Your Income and Spending

It’s time to take a hard look at where your money is going. Start by calculating your expected monthly income after taxes. If you’re budgeting for your family, include all household income.

Next, you’ll want to look at your last few months of expenses, and separate it into their respective categories. You need to know how much you’ve spent on gas, at the grocery store, going out to eat, etc. You can do this by reviewing your last bank statement and tallying up each category.

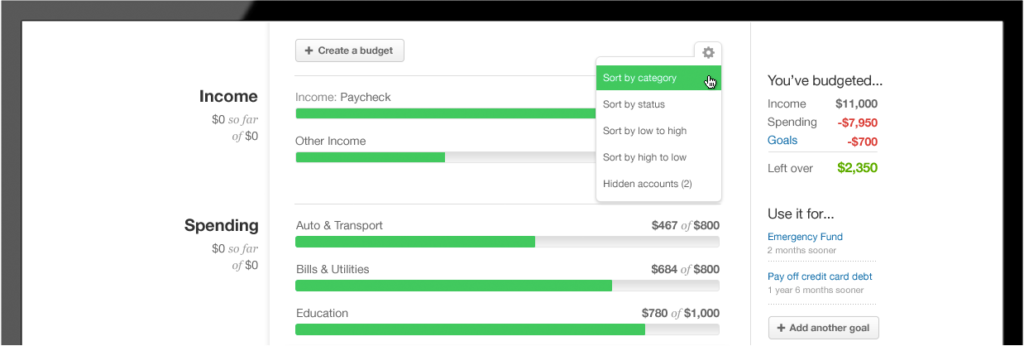

Alternatively, you can use a budgeting website- Mint. Mint updates continuously with your transactions from all of your accounts, and is completely confidential. You can set your budget in Mint once you have established it through this worksheet, and it automatically sorts your transactions into the categories you choose.

You can use Mint and only Mint for your budgeting, but I prefer to use it as a tool and also keep a written record of each month. This way, I can easily review the previous month’s categories and my whole year is kept in a neat binder. I’m not sponsored by Mint nor do I get any kind of compensation for you signing up- I really just like this website that much. They have an app too, so you can easily glance at your budget when you need to see how you’re doing during the month.

Your life is busy- budgeting should be simple.

The Budgeting Worksheet

Once you have an idea how much you’re spending each month, it’s time to fill in the expected amounts on your worksheet (the left column).

Fixed Costs

Fill in your expected costs for your fixed items. Some of these values like your mortgage, car payment, etc. will be the same each month, so you can just write them in the “actual” column if you choose to. For utilities and bills, using an average of the last few month’s numbers is a safe bet.

Let’s Talk Savings

Roughly 20% of your budget should be going into your savings each month. This could be into an emergency fund, a save for a house fund, travel fund, etc. At a bare minimum, be sure you are contributing to an emergency fund, or “rainy day fund”.

I’m going to be real with y’all for a second. In 2016, my husband was unexpectedly laid off due to budget cuts. Like, called me while I was shopping at Walmart and said “Um, I just got laid off.” No warning signs. At that point, I had just finished my Master’s Degree and had been looking for a job for a few months. Here we were suddenly both of us unemployed, and no income. We had only been married six months, so we didn’t have a lot in our emergency fund, but it was enough to keep us afloat and cover our move to a different city where we both got jobs. This is why you have an emergency fund. Even if you can only put away a small amount each month, do it!

Now that we both have jobs and are building back up our emergency fund, we’re also saving for a house. Whatever your financial goals are, write them in your savings category each month. Most importantly, put that money away at the beginning of the month, or as soon as you can. This way you’re less likely to “accidentally” spend it.

If you really need it, you can always transfer it back, but you’ll find that once it’s out of sight in your savings, it’s not likely that you’ll reach for it.

If you need some tips on managing finances as a couple without killing each other, hop on over here.

Entertainment

This is the fun part of budgeting- figuring out how much you can spend on YOU! I find that I’m way less likely to feel guilty about getting my nails done if I know it’s in the budget. It eliminates stress and allows you to enjoy the rewards from the hard work you put in Monday through Friday.

Items in this category are anything that could theoretically be eliminated and aren’t necessary (as much as Netflix feels NECESSARY in our house, it’s not a fixed cost).

Ok, now that we’ve done a quick run-down on the three categories, fill in your expected budgets. The first few months will be trial and error. You’ll learn where you spend less than expected and where you spend more.

End of Month Check-In

At the end of the month, you’ll go back and fill in the actual amounts you spent. This is where the truth comes out (though I hope you’ve been conscientious during the month and have been monitoring your spending.)

Calculate your totals, and figure out your percentages by dividing your total for each category by your total income, and multiplying it by 100.

How close did you come to the 50/30/20 guidelines?

Your first month will be a real eye-opener as you may begin to see that you’re living above your means. You should never be spending more than you bring in each month, but you also shouldn’t be spending just to spend, so to speak. I go in at the end of the month and highlight any category where we spent more than budgeted. We’ll talk about it as a couple and know that we need to make some changes the following month.

If you find you’re spending money on trivial things even though it’s within the 30% of your entertainment budget, consider adding that extra money to your savings instead. You can always adjust the percentages to find what works best for you!

It may take a few months, but I encourage you to find what works for you and your family and go with that.

Life will bring different seasons (literally and figuratively), so you should know that you can always be flexible with your budget. During Christmastime, you can add in a “gift” budget and cut back in other places. The purpose of this worksheet is to give you a clear picture of your finances each month. It’s up to you to stick to the budget.

Do you have any tips on budgeting? Any ways that you make sure you stick to your budget, or any issues you come across each month? I’d love to talk!

Thanks for reading,

Hello! I was really interested in the post and I did subscribe to your newsletter but yes I can’t downlaod the 12 month budget printable. Is there a link I can use?

Hi Jessica- you should have gotten it in your email- did you check spam by chance? If not, I can email it to you directly!